Home financing is the first step toward owning your dream home. Understanding the different options available can help you make informed decisions and ensure a smooth, affordable journey.

From choosing the right loan to improving your credit score, the process can seem complex. But with the right knowledge, you’ll be better prepared to navigate it successfully.

Ready to dive in? Let’s explore key tips and strategies that will help you secure the best home financing for your needs.

Understanding Home Financing Options

Understanding home financing options is essential for anyone looking to buy a house. There are various types of financing available, including conventional loans, FHA loans, and VA loans. Each option has its own requirements and benefits.

Conventional loans typically require a higher credit score and a larger down payment, whereas FHA loans are available to those with lower credit ratings and can require as little as 3.5% down. VA loans, on the other hand, are designed specifically for veterans and active-duty military personnel and often come with no down payment and no mortgage insurance.

It’s important to compare the terms and conditions of each loan type, including interest rates, repayment periods, and additional fees. Additionally, shopping around for lenders can help you find better rates and terms, ultimately saving you money in the long run.

Understanding your financial situation will also aid you in selecting the option that best fits your needs. Assess your credit score, desired loan amount, and monthly budget before making a decision. By arming yourself with knowledge about options, you’re better positioned to make informed choices on your journey to homeownership.

How to Improve Your Credit Score

Improving your credit score is a vital step for home financing. A higher score can lead to better loan terms and interest rates. Here are some effective strategies:

- Pay your bills on time, as payment history accounts for a large part of your credit score;

- Reducing your credit utilization ratio is also critical; try to keep it below 30%;

- Additionally, avoid opening multiple new credit accounts at once, as this can negatively impact your score;

- Review your credit report regularly to check for errors and dispute any inaccuracies;

- Consider becoming an authorized user on a responsible person’s credit card, which may help boost your score;

- Be patient; building or improving your credit score takes time but can lead to significant savings in the long run.

Steps to Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is an important step in the home buying process.This process helps you understand how much you can borrow and shows sellers you’re a serious buyer.

Start by gathering your financial documents, including tax returns, pay stubs, and bank statements.Next, research different lenders to find one that offers competitive rates and terms.

Once you’ve selected a lender, fill out the mortgage application. The lender will review your financial history and credit score.Be prepared to answer questions about your income and debts.

After reviewing your application, the lender may issue a pre-approval letter, stating the amount you are qualified to borrow. This letter can give you an edge in negotiations with sellers.

Keep in mind that pre-approval is not the same as a final mortgage offer, as it will be confirmed upon the final review of your chosen home.

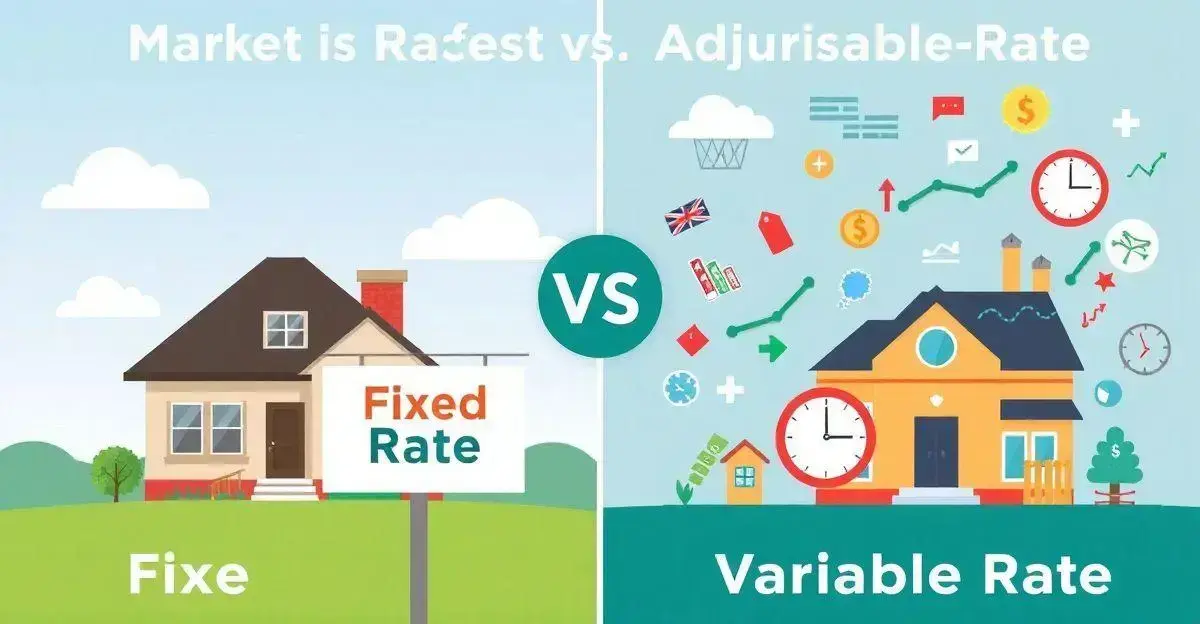

Comparing Fixed vs. Adjustable-Rate Mortgages

When choosing a mortgage, it’s important to compare fixed and adjustable-rate mortgages. A fixed-rate mortgage means your interest rate stays the same throughout the loan term. This can provide stability in your monthly payments, making it easier to budget.

On the other hand, an adjustable-rate mortgage (ARM) starts with a lower interest rate that may change after a set period. While this can result in lower payments initially, your payments could increase significantly when the rate adjusts.

Consider how long you plan to stay in your home; if it’s a long-term commitment, a fixed-rate mortgage may be the best choice. However, if you think you will move within a few years, an ARM could save you money.

It’s also wise to review how often the rate adjusts and what the maximum rate could be. By understanding the pros and cons of each type, you can make a more informed decision that aligns with your financial goals.

Exploring Down Payment Assistance Programs

Exploring down payment assistance programs can open doors for many homebuyers. These programs are designed to help individuals and families save money when purchasing a home.

Many state and local governments offer assistance in the form of grants or low-interest loans that cover down payment costs, which can be a significant hurdle for first-time buyers.

Eligibility requirements often vary based on income, credit score, and the location of the home. Some programs are even specific to certain professions, like teachers or healthcare workers.

To find a suitable program, start by checking with local housing authorities or your lender, who can provide information about available assistance options.

Applying for these programs typically involves filling out an application and providing financial documentation, such as income verification and debt information.

With the right assistance, you may be able to secure a home without the burden of a large upfront down payment, making homeownership more attainable.

The Role of Private Mortgage Insurance (PMI)

The role of Private Mortgage Insurance (PMI) is crucial for homebuyers who make a down payment of less than 20%. PMI protects the lender in case the borrower defaults on the loan.

While it may seem like an extra cost, PMI allows buyers to purchase a home sooner by reducing the need for a larger down payment. Typically, PMI can be paid monthly along with your mortgage payment, or as a one-time upfront fee at closing.

It’s important to understand the costs associated with PMI, as they can vary based on the loan type and the amount of the down payment. Once your mortgage balance drops below a certain level, you may be able to cancel PMI. This option can save you money each month, making it important to track your mortgage progress.

By being informed about PMI, you can better plan your budget and improve your overall financial health while pursuing homeownership.

Common Mistakes to Avoid in Home Financing

Common mistakes to avoid in home financing can save you time and money.

One major mistake is not checking your credit score before applying for a mortgage. Your credit score significantly affects your interest rate and loan approval.

Another mistake is not budgeting for additional costs such as closing fees, property taxes, and maintenance. Many buyers focus only on the mortgage payment without considering these extra expenses.

Underestimating your debt-to-income ratio can also impact your ability to get a loan. Lenders look for a low ratio, which means your monthly debt payments should be a small portion of your income.

Failing to shop around for the best mortgage can result in missing out on lower rates. Different lenders may offer varying terms and fees, so it’s crucial to compare options.

Lastly, not asking questions during the mortgage process can lead to misunderstandings about the terms and conditions. Always feel free to seek clarification from your lender to ensure you understand every aspect of your loan.

Tips for Refinancing Your Home Loan

Tips for refinancing your home loan can lead to better financial terms and savings. Start by assessing your current mortgage to see if refinancing is beneficial. Look at interest rates, loan terms, and any fees associated with refinancing.

It’s often a good idea to refinance if you can reduce your interest rate by at least 0.5% to 1%. Gather necessary documents such as your credit report, income verification, and current loan details.

Another important step is to check your credit score; a higher score can result in better rates. Additionally, consider the length of time you plan to stay in your home. If you’re staying long-term, refinancing may save you more in the future.

Always compare offers from multiple lenders to find the best terms. Finally, keep an eye out for closing costs associated with refinancing to ensure it doesn’t outweigh the savings from lower payments. Staying informed can help you make smart financial choices when it comes to refinancing your home loan.

How to Choose the Right Lender

How to choose the right lender is a crucial step in your home financing journey. Start by researching different lenders to understand the options available. Look for lenders who have experience with your specific financial situation, whether it’s a first-time home purchase or a refinance.

Compare interest rates, loan types, and terms from multiple lenders to find the best fit. Ask about fees and other costs involved, such as closing costs and private mortgage insurance.

Reading reviews and getting referrals from friends or family can provide insights into a lender’s reputation and service quality. It’s also important to assess the lender’s responsiveness; a lender who is easy to contact can make the process smoother.

Finally, make sure to ask questions about the loan process and timelines to ensure you are well-informed. Taking the time to select the right lender can lead to better financing options and a more satisfying home buying experience.

FAQ – Frequently Asked Questions About Home Financing

What is the importance of checking my credit score before applying for a mortgage?

Your credit score significantly affects your mortgage interest rate and loan approval chances, making it essential to check it beforehand.

What are the common down payment assistance programs available?

Many state and local governments offer grants and low-interest loans to help cover down payments for eligible homebuyers.

What is Private Mortgage Insurance (PMI) and when is it needed?

PMI is required for homebuyers making a down payment of less than 20% and protects the lender if the borrower defaults on the loan.

How can I identify the best lender for my mortgage?

Research lenders, compare their interest rates, terms, and fees, and check reviews to find a lender that suits your needs.

What mistakes should I avoid when financing a home?

Common mistakes include not budgeting for additional costs, underestimating your debt-to-income ratio, and failing to shop around for rates.

What are the benefits of refinancing my home loan?

Refinancing can lower your interest rate, reduce monthly payments, and allow you to access home equity for other expenses.